California’s legal cannabis industry has reached a pivotal point, with the number of inactive and surrendered licenses now exceeding active ones. According to the Department of Cannabis Control’s (DCC) data dashboard, there are currently 10,828 inactive licenses compared to 8,514 active licenses statewide. This shift comes seven years after the state’s legalization of cannabis and highlights the ongoing struggles within the regulated market.

Industry Experts Voice Concerns

Jonatan Cvetko, executive director of the United Cannabis Business Association, described the current regulatory framework as a “complete failure.” He emphasized that the industry has reached a threshold where the number of participants who have failed now outweighs those succeeding. Cvetko attributes this trend to excessive regulations and the proliferation of unlicensed operators, which create an uneven playing field for licensed businesses.

State Officials Provide Context

David Hafner, a spokesperson for the DCC, contested the notion that the increase in inactive licenses signifies market failure. He explained that part of the decline in active licenses is due to a procedural change in 2023, allowing cannabis farms to consolidate multiple smaller licenses into a single, larger one. This consolidation accounts for 1,071 inactive licenses and does not necessarily indicate business closures or downsizing.

Impact on Cultivation and Local Communities

Despite these clarifications, the majority of inactive licenses pertain to cultivation, with over 7,100 inactive cultivation licenses reported. This decline reflects a significant reduction in small-scale farms, particularly in Northern California, which once served as a hub for cannabis cultivation. Dan Sumner, a professor at UC Davis who has extensively studied California’s cannabis industry, noted that many large farming operations have shut down due to falling wholesale prices and stringent regulations, making legal cultivation increasingly unprofitable.

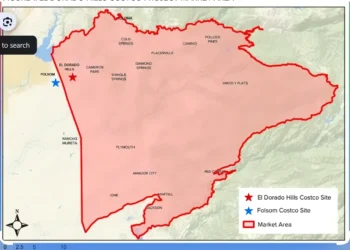

El Dorado County’s Position

In El Dorado County, the cannabis industry remains modest. As of 11 months ago, the county had approved 12 commercial cannabis projects, including a mix of retail, distribution, and delivery services. However, local tensions have arisen, particularly between cannabis cultivators and established wine growers. Some vintners have expressed concerns over the proximity of cannabis operations to vineyards, fearing potential impacts on their crops and tourism appeal.

Looking Ahead

The challenges facing California’s legal cannabis market are multifaceted, involving regulatory complexities, market dynamics, and competition from unlicensed operators. Addressing these issues will require coordinated efforts from policymakers, industry stakeholders, and local communities to create a sustainable and equitable environment for legal cannabis businesses.

Sources:

- Department of Cannabis Control Data Dashboard: https://cannabis.ca.gov/resources/data-dashboard/

- “Complete failure: California pot industry hits another grim milestone” – SFGate: https://www.sfgate.com/cannabis/article/complete-failure-calif-pot-industry-dead-licenses-20165785.php

- “El Dorado County wine growers upset over cannabis grow’s green light” – CBS News: https://www.cbsnews.com/sacramento/news/el-dorado-wine-growers-upset-over-cannabis-grow/

Note: This article reflects data and events as of February 17, 2025.