SACRAMENTO, Calif. — California’s minimum wage is set to increase again on Jan. 1, 2026, a change affecting millions of workers statewide and adding to ongoing debates about cost of living and business affordability.

Under state law, the minimum wage in California will rise from $16.50 to $16.90 per hour for most employees, regardless of employer size. The annual adjustment is automatically calculated based on inflation and cost-of-living data, as required by state Labor Code.

Gov. Gavin Newsom’s administration notes the increase is part of a package of new workforce protections and economic policies aimed at enhancing equity for workers. “With these new laws, California is raising its standards and creating a more fair and equitable environment for its workforce,” said California Labor Secretary Stewart Knox in announcing broader changes taking effect Jan. 1.

The change also affects salaried employees exempt from overtime: under state rules, exempt employees must earn at least twice the minimum wage for a full-time work schedule, which means a salary of at least $70,304 per year in 2026.

Growing patchwork of local rates

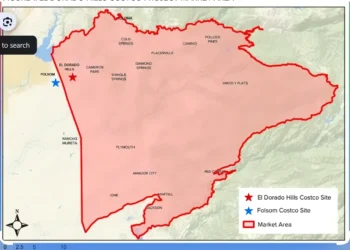

Statewide is a floor, not a ceiling: many California cities and counties already enforce higher minimum wages based on local cost-of-living measures. For example, nearby Bay Area cities and counties will have rates ranging from about $17.38/hour in Sonoma (for small employers) to over $19/hour in other jurisdictions, depending on location and employer size.

For El Dorado County itself, where much of the local economy is tied to retail, tourism, and small business, businesses will need to ensure payroll compliance if they employ workers within city limits that adopt higher local rates. However, most of the county currently follows the state level minimum wage. (Local enforcement offices and municipal clerks can provide specific city wage ordinances.)

Local employer concerns and community impact

Some business owners express concern that consecutive wage increases compound pressures on budgets already squeezed by rising housing, energy, and supply costs. “We support fair wages, but mandates without support make it harder for small businesses to thrive,” said one local retailer who asked not to be named, citing concerns about hiring and pricing.

Economic analysts note that while wage increases can help low-wage workers better cover basic expenses, such as rent and groceries, they don’t fully offset California’s high cost of living. In many parts of the state, a worker earning the minimum wage would need to work more than a typical full-time week just to afford modest rent for a one-bedroom apartment.

What workers and employers should do now

The California Department of Industrial Relations and local labor offices encourage employers to review payroll systems, update wage notices, and communicate changes to staff. Workers who believe they are paid below the legal minimum are advised to contact the Labor Commissioner’s Office to learn about wage claim procedures.

As California enters 2026, the minimum wage increase underscores a broader challenge: balancing efforts to improve worker earnings with ongoing affordability issues facing families and businesses across the state.