By Cris Alarcon, InEDC Writer. (May 3, 2025) —

EL DORADO HILLS, Calif. (InEDC) — El Dorado County Auditor-Controller Joe Harn has declined to include certain Lighting and Landscaping Assessment District (LLAD) fees on property tax bills, citing concerns over their legal defensibility. This decision has led to a dispute with the El Dorado Hills Community Services District (EDHCSD), which relies on these fees for maintaining local infrastructure.

In 2022, Harn omitted LLAD assessments totaling approximately $1.4 million from over 20 districts in the EDHCSD area. He stated that discrepancies existed between the assessments submitted by EDHCSD consultants and those approved by the district’s Board of Directors. Harn requested a letter from EDHCSD officials confirming the accuracy and legality of the assessments, a practice previously followed, but no such letter was received.

“If the CSD board isn’t responsible for the assessments, who is?”

Harn questioned, emphasizing the need for accountability in the assessment process.

EDHCSD officials have contested Harn’s actions, arguing that his requirement for an indemnification letter lacks legal basis. In a statement, the district claimed the auditor’s refusal is rooted in concerns about public scrutiny and not in legal obligations. They further accused Harn of

“political pandering” and labeled him “a bully on the playground.”

The dispute has escalated to legal action, with EDHCSD filing a lawsuit against Harn. Harn described the lawsuit as

“a colossal waste of money,”

noting that the suit inaccurately stated a unanimous board vote on the assessments, whereas one director had voted against them.

The omission of LLAD fees has financial implications for EDHCSD, potentially affecting maintenance services funded by these assessments. Harn indicated that issuing supplemental property tax bills could cost around $60,000, an expense the county would initially bear and later recover from LLAD funds.

This situation underscores the complexities of local governance and the importance of clear communication and legal compliance between county officials and special districts.

For further information, please refer to the El Dorado County Auditor-Controller’s Office and the El Dorado Hills Community Services District.

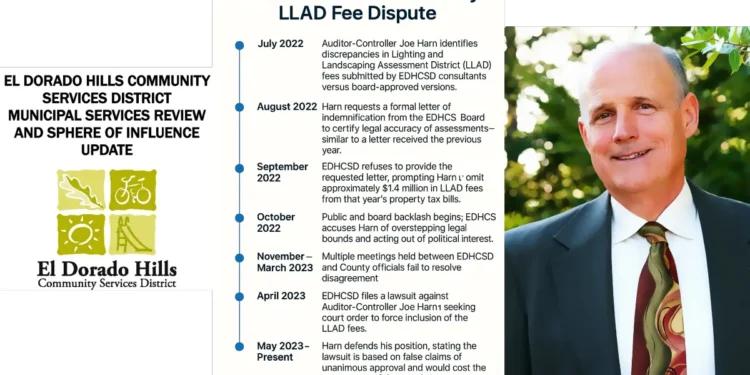

Timeline: El Dorado County LLAD Fee Dispute

July 2022

Auditor-Controller Joe Harn identifies discrepancies in Lighting and Landscaping Assessment District (LLAD) fees submitted by EDHCSD consultants versus board-approved versions.

August 2022

Harn requests a formal letter of indemnification from the EDHCSD Board to certify legal accuracy of assessments—similar to a letter received the previous year.

September 2022

EDHCSD refuses to provide the requested letter, prompting Harn to omit approximately $1.4 million in LLAD fees from that year’s property tax bills.

October 2022

Public and board backlash begins. EDHCSD accuses Harn of overstepping legal bounds and acting out of political interest.

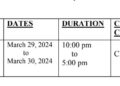

November 2022 – March 2023

Multiple meetings held between EDHCSD and County officials fail to resolve the disagreement.

April 2023

EDHCSD files a lawsuit against Auditor-Controller Joe Harn, seeking a court order to force inclusion of the LLAD fees.

May 2023 – Present

Harn defends his position, stating the lawsuit is based on false claims of unanimous approval and would cost the county tens of thousands in supplemental billing.

Legal proceedings are ongoing, with implications for future assessment processes and district funding.

ADDENDUM by John Juanito Davey