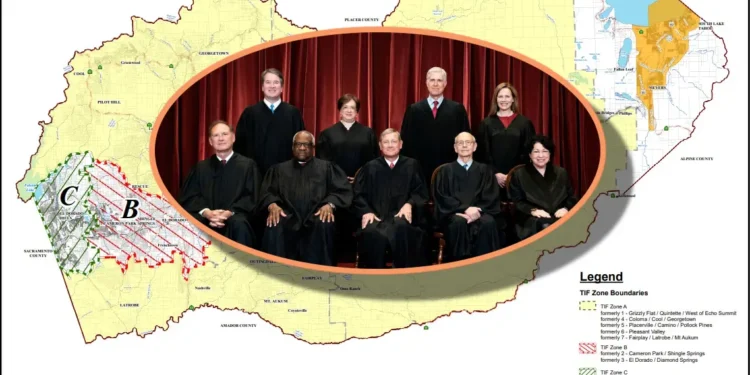

El Dorado County (January 9, 2024) – The Supreme Court displayed a keen interest in re-evaluating the rights of property owners during a hearing on Tuesday. A California property owner, George Sheetz, seemed to gain traction in his challenge against $23,420 permitting fees incurred while constructing a new house. The court indicated agreement on a narrow aspect that could overturn a California appeals court ruling. Justice Neil Gorsuch suggested a return for arguments on broader questions concerning the county fee’s permissibility. Sheetz’s case challenges El Dorado County’s Traffic Impact Mitigation Fee Program, arguing violations of constitutional tests outlined in Nollan v. California Coastal Commission and Dolan v. City of Tigard. El Dorado defends the fee as distinct from Nollan and Dolan scrutiny. The court’s deliberations signify a broader interest in balancing government regulations with property owner rights, reflecting a trend in the Supreme Court’s attention to property rights and takings cases.

High-stakes Legal Battle Over $23,420 Building Fee Puts California’s Impact Fees in the Crosshairs

In a potentially groundbreaking case with far-reaching consequences, the Supreme Court heard arguments today in a dispute between a 72-year-old retiree, George Sheetz, and El Dorado County over a $23,420 building fee. The case delves into the justifiability of “impact fees” imposed on new construction projects to offset the strain on local infrastructure.

At the heart of the matter is the extent to which cities and counties must substantiate these fees. In California, where impact fees can substantially increase housing project costs, the outcome could reshape local government budgets and impact housing markets nationwide.

Sheetz, backed by the Pacific Legal Foundation, contends that El Dorado County failed to prove the fee’s correlation with the wear and tear his small project would impose on local roads. His argument challenges a four-decade-old Supreme Court precedent and seeks to establish new standards for justifying such fees.

While Sheetz’s case draws support from building industry groups and property rights advocates, city and county government associations, along with the state and federal governments, rally behind El Dorado County. The court grappled with whether the fee should be treated as government seizure, a simple tax, or an intermediate category.

California’s reliance on impact fees, exacerbated by Proposition 13’s limitations on property taxes, makes this case particularly crucial. The court’s conservative majority, expected to align with Sheetz, may demand heightened scrutiny for justifying fees, potentially affecting widely-used housing and revenue-raising policies.

The case highlights a broader debate on the reasonableness of impact fees, which in 2015 were four times higher in California than in other states. The outcome could impact local financing for infrastructure, and critics argue it may slow down development processes, exacerbating the ongoing housing crisis.

As the Supreme Court grapples with the complexity of the case, its decision may set a precedent, opening a constitutional discussion with implications for various types of fees, including those tied to public art or affordable housing mandates. The outcome remains uncertain, with potential implications for property owners, local governments, and housing affordability in California and beyond.