PLACERVILLE, Calif. (InEDC) — El Dorado County officials are grappling with a significant budget shortfall as declining sales and property tax revenues force difficult decisions, including cuts to staff and services. The Board of Supervisors has approved a $1.06 billion budget for the 2024-25 fiscal year, which relies on $12.6 million in one-time funds—a strategy county officials acknowledge is unsustainable. inedc.com

“Difficult decisions and strong fiscal discipline will be essential,”

said Chief Administrative Officer Tiffany Schmid.

“The employees and residents of our County are relying on us to lead and deliver results.”

Revenue Declines Prompt Service Reductions

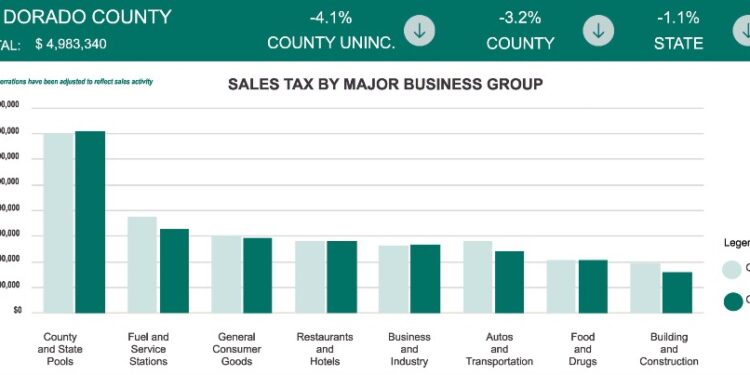

The county’s financial challenges stem from a combination of factors. Adjusted sales tax revenues declined by 4.1% in the fourth quarter of 2024 compared to the same period in 2023, with notable decreases in fuel-service station receipts (down 12.3%) and auto-related sales (down 13%). Building-construction revenues also fell by 18% due to decreased contractor activity.

Property tax growth has slowed, dropping from 6.37% in the previous fiscal year to 4.69%, with projections indicating a further decline to 3.5%.

In response, the Board of Supervisors has directed departments to prepare for potential budget reductions of 5% to 10%, with plans to assess service impacts in the fall.

Cuts to Tourism and Economic Development Funding

One of the most controversial decisions involves the reallocation of Transient Occupancy Tax (TOT) funds. Historically, TOT revenues supported tourism and economic development initiatives. However, the Board voted to redirect these funds to core county services, resulting in the elimination of $868,567 in discretionary funding to outside agencies, including the Lake Tahoe South Shore Chamber of Commerce and the Tahoe Prosperity Center.

“I am in support of the board’s priority to fund county services,”

said District 5 Supervisor Brooke Laine, the sole dissenting vote.

“I voted against the motion because I felt just ‘pulling the carpet out from underneath the outside agencies’ feet’ was rather inhumane.”

Steve Teshara, director of government relations for the Tahoe Chamber, expressed concern over the cuts.

“If the county is eliminating funds from tourism, I don’t know if they can have a realistic expectation for how those funds are expected to grow,”

Exploring New Revenue Streams

To address the structural budget imbalance, the Board has tasked the Budget Ad Hoc Committee with researching additional discretionary revenue-generating options. These may include ballot measures to increase sales and use taxes, TOT, and the establishment of tourism or assessment districts. eldorado.legistar.com

The county’s Measure S, approved by voters in 2022, increased TOT specifically for snow removal and road maintenance in the unincorporated Tahoe area. The Measure S Citizens’ Oversight Committee continues to monitor the allocation of these funds to ensure transparency and accountability. El Dorado County

Looking Ahead

County officials acknowledge that relying on one-time funds is not a sustainable solution. Schmid plans to present strategies for achieving a structurally balanced budget in the coming months, emphasizing the need for long-term solutions to maintain essential services for residents and visitors alike. El Dorado County